About Us

eDon Fintech Limited (“eDon") is a joint venture between ComplianceOne Consulting Limited ("ComplianceOne") and X Fintech Asia Limited ("X Fintech"). With our extensive experience in regulatory compliance and information technology, we have a thorough understanding of the regulatory framework in Hong Kong, the Greater Bay Area, and worldwide. We develop compliance strategies that comply with local regulations for regulated financial institutions.

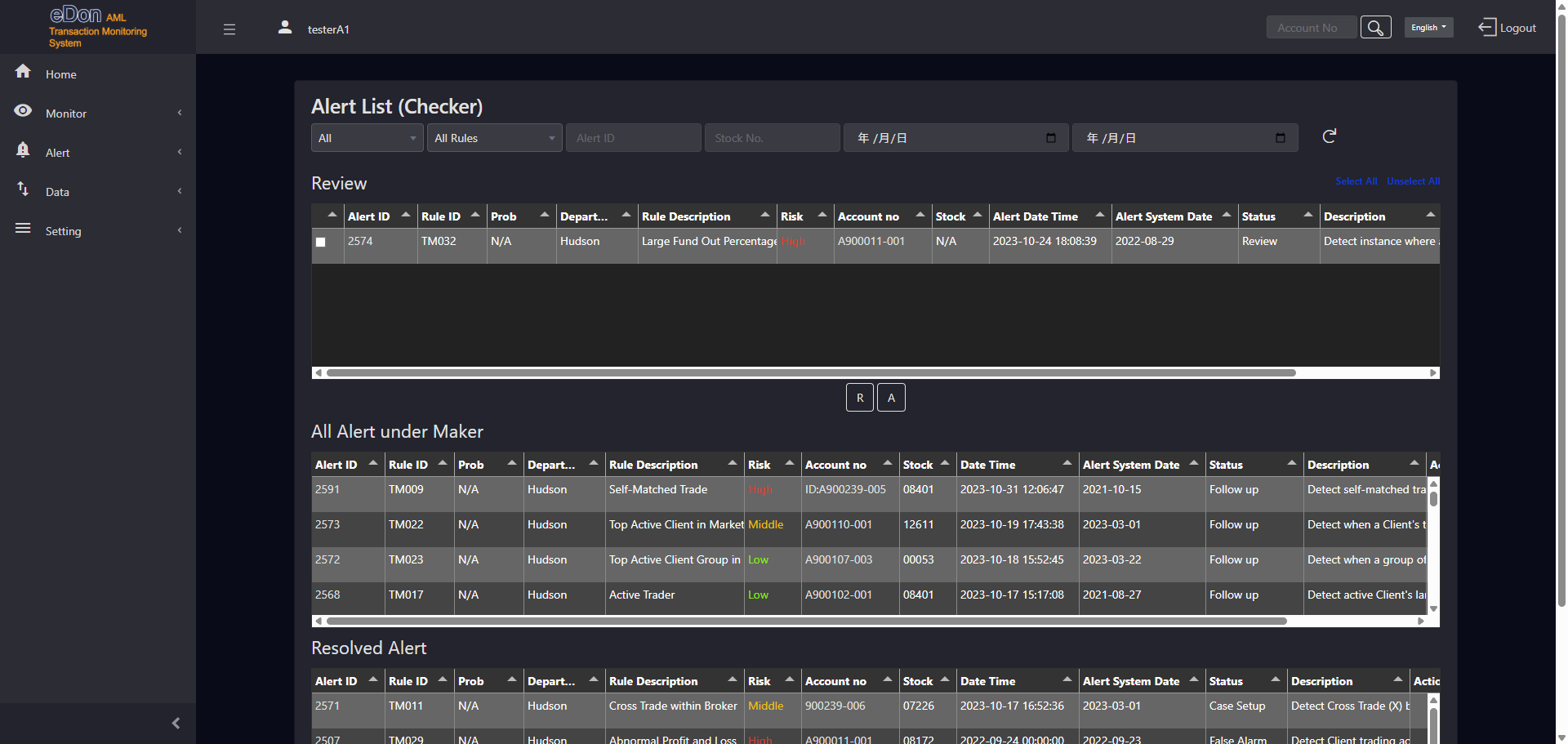

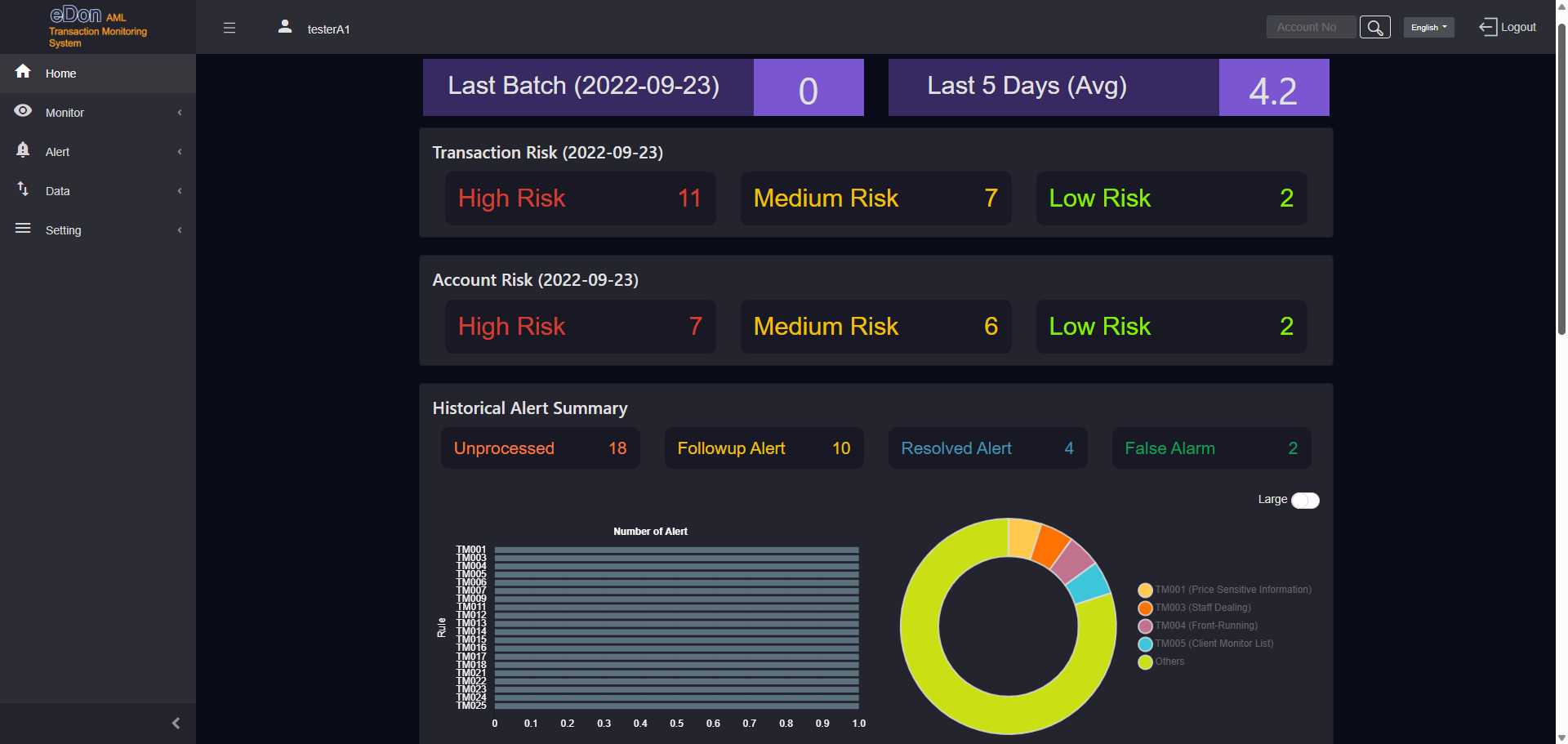

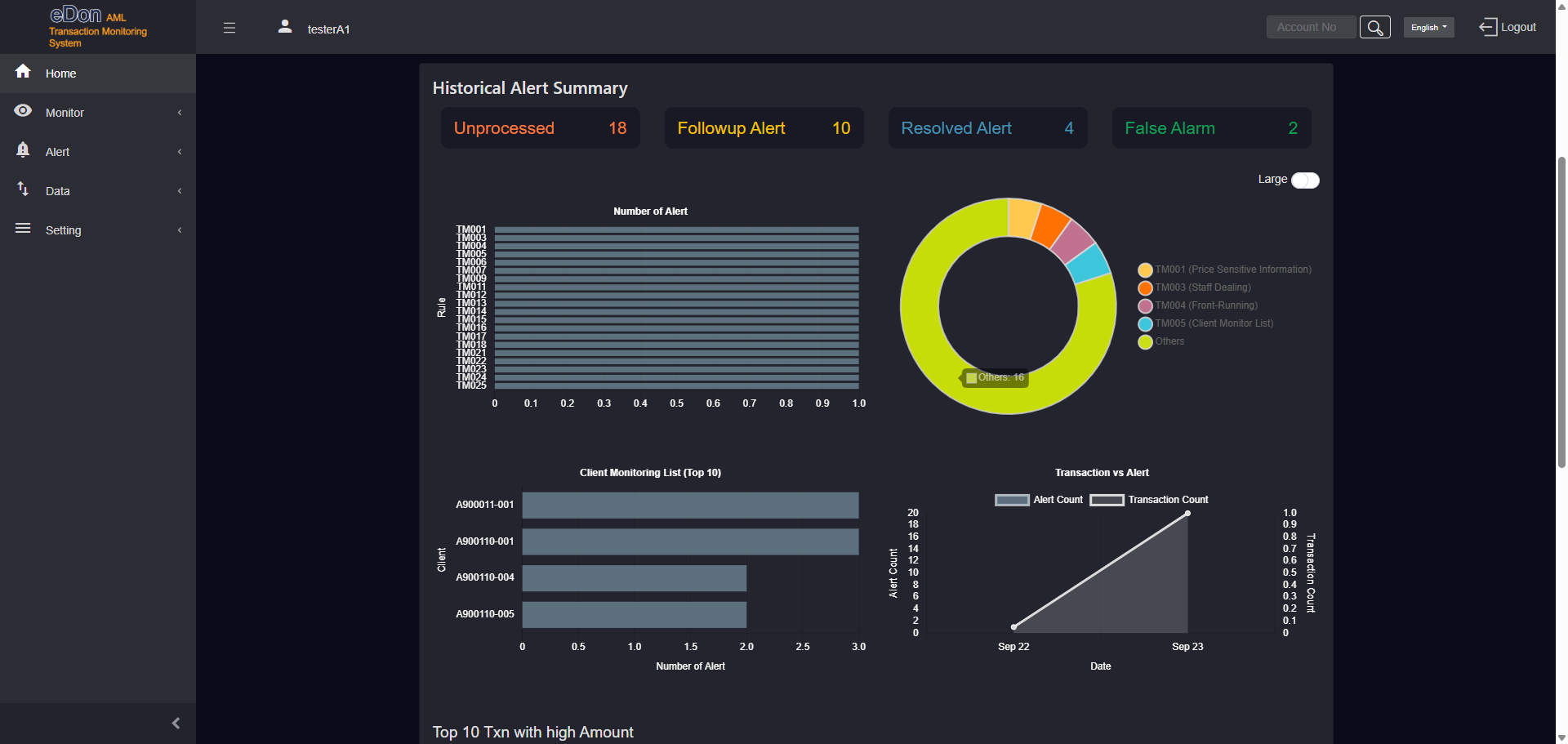

In light of this, we have developed Screen-X AML/CRM Solutions (“Screen-X”) to provide financial institutions with a fully automated anti-money laundering system that meets regulatory requirements and helps reduce operational risks and enhance operational efficiency.

In the globally integrated financial system, all financial institutions must strictly comply with regulations and conduct effective customer due diligence (“CDD”) and risk management.

For the database of Screen-X, we have selected Acuris Risk Intelligence (“ARI”) as the primary service provider. In the future, we will also integrate databases from around the world to provide users with more sophisticated risk management databases.