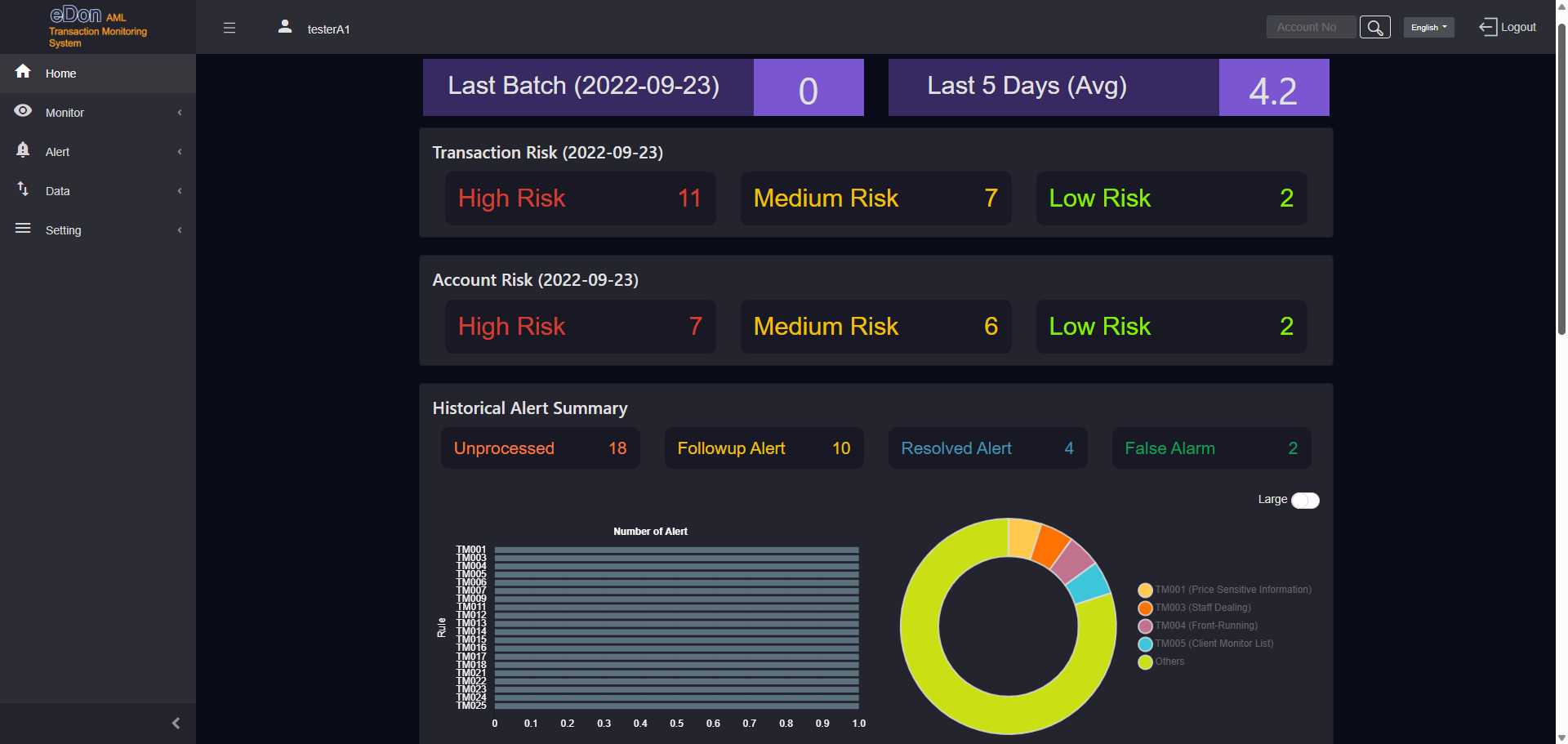

Applicable Customers

Exchange Participants

Category A, B, C Stock

High Transactions Volume

Complex business model or clientele

Meeting SFC Requirements (especially Pre-inspection and Post-inspection)

Required by Group Companies or Parent Companies

Enhancing Internal Controls